The Easiest Way To Renew Your Motor Insurance in Malaysia

If you own a car, renew the car insurance between the responsibilities that need to be done each year. Here's an important point you need to take note of as well as ways to save costs while renewing your car insurance.

Do It Yourself vs. Use Insurance Agent Services?

You have two options for renewing car insurance - you can renew it yourself, or with the help of an insurance agent.

By using an insurance agent, you must provide all necessary information (such as a car chassis and engine number), and make a payment. The agent will handle all your auto insurance reform process. The cost of payment will be determined by the current value of your car, and the type of protection you choose. Normally, an insurance agent will also renew your road tax. However, the steps of using an insurance agent will cost more because the insurance agent will charge a service charge.

If you are dealing directly with an insurance company to renew your car insurance, do not go through insurance agents and you will enjoy up to 10% discount. Here are the steps to take:

- Determine the current value of the car (can refer to the MyCarInfo website) and check the percentage of No Claim Discount (NCD) that is eligible for you. You can then get a rough estimate of the cost of insurance for the car. Remember, however, that this assessment is just a guide. The actual value of the car may vary depending on the state of the car.

- Provide necessary documents, such as insurance cover notes, existing insurance policies, and car grants.

- Go to any insurance company and get a quote for car insurance. If you are satisfied, make a prepayment. The insurance policy will be sent within one day, and the original copy is sent by email or post.

- Once you have renewed your car insurance, you will need to renew the road tax. It can be done through BolehCompare.com, at JPJ branch, or Post Office.

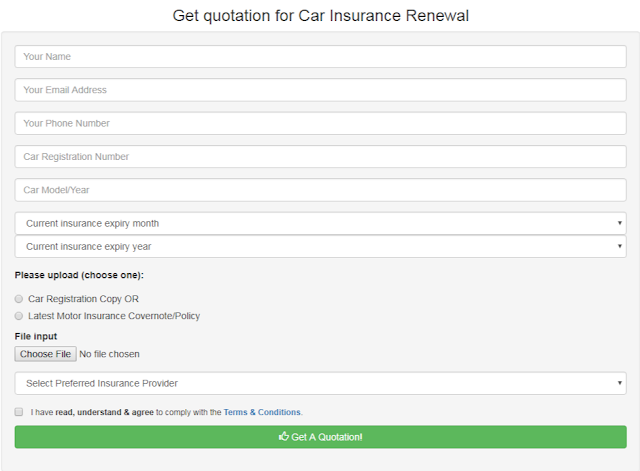

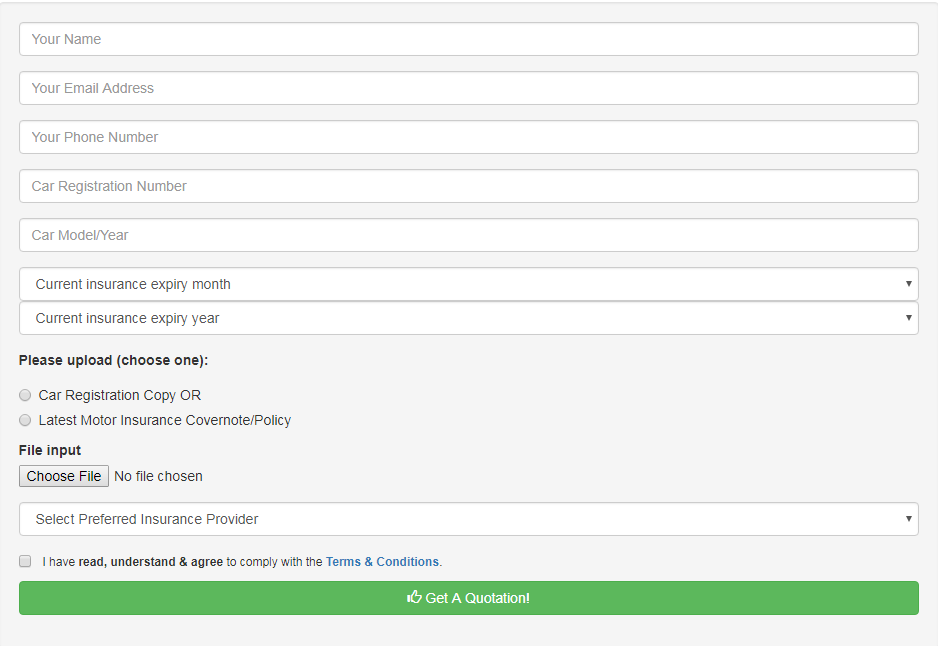

You can also renew your car insurance and road tax through BolehCompare.com You need to complete the following information

What You Need to Know About The Car Insurance Reform Process

If you buy a car insurance that provides less protection than the current market value of your car, in the event of an accident you have to pay for the remaining balance. So, you can only claim a portion, that is, up to the amount of cover provided by your insurance policy.

On the other hand, it can happen where you buy insurance over the current market value of your car. However, the maximum amount you can claim in case of an accident is based on the current market value of the car, rather than what you pay for. This is to prevent car owners from gaining profit from their car insurance claims.

So, how to make sure you are not over or under insurance coverage? You need to know the current market value of your car. How? Refer to below.

Market Current Market Value

When renewing car insurance, the current market value of the car is among the most important information to know. The value will not be the same as what you pay when you buy the car, as it will go down every year. One of the fastest ways to know the value of your car is through the MyCarInfo website. This free portal provides the service to check the current market value of the car, and receive sample reports. If you want additional information, the full report price is RM6.36. You need to know the year of your car production to get the most accurate market value.

As stated, the current market value will not be accurate, as each insurance provider and financial institute have different computational formulas.Therefore, do a check on determining the market value of your car. The estimated car market value can also be obtained from the car insurance provider you are currently using.

By knowing the current market value of the car, you can avoid over-incidence, or under-insurance coverage

Check the Value of No Claim Discount (NCD)

NCD is one of the important factors when renewing car insurance. NCD entitles you to get a discount on renewal of insurance, provided you have not made any claim within the past 12 months. If you have a claim, the qualification will be dismissed, and you can not claim the discount.

This does not mean that you do not have to make insurance claims if you are involved in an accident. The eligibility is only forfeited if the accident arises from you. If you are involved in an accident, and this is not due to your actions, the NCD qualification will not be dismissed when you make a claim.

NCD discount rates have been set based on the Malaysian Motor Insurance Association (PIAM) Motor Tariff:

If you have renewed your insurance without taking into account the NCD discount, you can notify the insurance agent or supplier for the NCD discount, and get the excess balance from the discount. Normally you will receive a refund for NCD discount in cheque.

You Can Change the Insurance Provide

Finally, you can switch to another car insurance provider company after your current insurance expires. You do not have to be subject to the same insurance provider. As a user, you have the choice and power to make decisions. Get quotes from different insurance providers, and compare the protection plans offered. Sometimes, taking car insurance from a new supplier can save money, especially from suppliers offering rebates.

No comments:

Post a Comment